I used to have a rule of thumb: I’d buy any single-family home at 20% below current market value. Now, I’m not so sure.

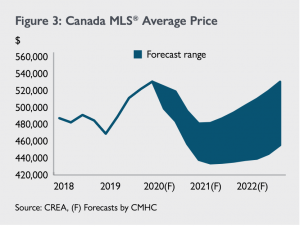

On May 27, Canada Mortgage & Housing Corporation (CMHC) released a special edition of their Housing Market Outlook. In it there’s a chart that says average existing Canadian home prices may decline by 9% to 18%.

It was met, by people whose livelihoods are tied to ever-increasing real estate euphoria, with outrage!

Did you know that over half of Canada’s GDP is driven by real estate? Apparently those who stand to benefit from a never-ending real estate appreciation party — Realtors®, mortgage brokers, lenders, and politicians — can’t bring themselves to consider the notion of a potentially stalling economy.

I’ve even heard from respected property owners in Toronto, Vancouver, and Alberta: “Yes, prices may drop, but not in my town.” Seriously? These are the markets that drive the country, and the report was segmented by province, specifically addressing Ontario, BC and Alberta.

We cannot drive the direction of a market by positive thinking alone. Hope is not an investment strategy. What if we’re missing something?

As of mid-May, Warren Buffett had a stockpile of $137B in cash. Do you know why? Even though the stock market faltered, as a value investor, he still hasn’t found any bargains. He knows there’s more pain to come, and is patiently waiting.

Why then would we, as real estate investors, be any different?

Sure, to be fair, the report opened with: “The housing outlook is subject to unprecedented uncertainty due to the pandemic”. But, if you had a chart, produced by a team of industry experts, showing values dropping by almost 20%, wouldn’t you at least try to understand it?

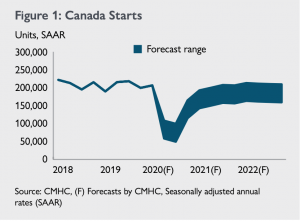

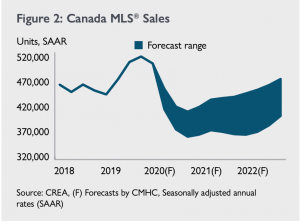

Yes, real estate markets are driven by Supply & Demand. On the supply side: Housing Starts. On the demand side: Buyers with access to cash and credit.

Here’s what the 3 national charts look like:

Supply up; demand down. Not good. The result is a precipitous and sustained drop in prices, and real estate markets are heavy: It can take 2-3 years for a market to find bottom, and then for the supply/demand cycle to reset. When they fall, they often fall fast, and rise slowly — meaning it could take several years to recoup losses of an ill-timed investment.

Microeconomic factors like location, comparables and condition of a home will be of little consequence if they’re overpowered by a tsunami of Macroeconomic factors.

Here are 8 reasons why CMHC might be right:

#1. How do we know CMHC wasn’t signalling imminent policy changes?

Well, only one week following release of the report CMHC announced stricter qualifications for insured mortgages: lower debt service ratios, higher credit score minimums, and a ban on borrowed down-payments. True, there are other mortgage insurers. So far, Genworth hasn’t followed suit in tightening its requirements. How long will that last? And, are there more policy changes to come?

#2. What if there’s a liquidity crisis?

‘liquidity crisis’: a shortage of cash or other immediately available funds to meet financial needs

You may already know that employment (jobs & wages) are key drivers of real estate values. People go where there’s work.

-

-

- Have you considered that some businesses may be gone forever, and jobs with them?

- What about lost income due to work interruption?

- What if business owners, existing and new, decide to direct hard-earned cash toward keeping their doors open, and prioritize the source of their livelihood over upgrading to a new neighborhood?

- For self-employed people, it takes two years of verifiable income to qualify for new mortgage financing. If their income in 2020 has been sufficiently bruised, it could be 2023 before they reenter the housing market.

- What if all this has been a wake up call, and people begin prioritizing debt-reduction and develop a new bias for saving? Did you know that Canadians now owe almost $1.77 for every dollar they have available to spend?

-

#3. What about demographics?

Did you know that household formation is considered the underlying driver of long-term demand for new housing and construction? Canada’s fertility rate has been in decline every year since 2008, and is now less than 1.5%? If it takes 2 people to make a child, and they’re only producing, on average, one and a half, then our population is shrinking. This means, without immigration, there will be fewer people to buy your house.

#4. So let’s talk about Immigration:

What if global mobility is interrupted for an extended period of time due to the pandemic? Of course, there’s always interprovincial migration. What makes you think more people will be moving to your province rather than away from it?

#5. What about increasing costs of home ownership…

… due specifically to the hangover from a pandemic? More money put into keeping a home means less available to buy one.

-

-

- Consider interest rates; there seems to be a general consensus that they’ll remain low for a very long time. But money supply is subject to the laws of supply and demand too, and increased risk of default could result in a risk premium — higher rates.

- How about property taxes? COVID-19 has dealt a severe blow to municipal finances. How will we pay for that? Higher property taxes?

- And, insurance rates on multifamily buildings (condos, apartments, townhouses) have already increased by an average of 65%, in some cases much more, due to an avalanche of claims in recent years (water-damaged buildings in Vancouver, floods in Calgary, fire in Fort McMurray…). The whole insurance industry’s business model has been crippled by persistently low interest rates. Now, to add insult to injury, there are new Coronavirus-related claims. Did you know that large events like Wimbledon routinely carry cancelation insurance? Those payouts are huge!

- What about income tax? How are we going to pay for all the stimulus? If more money goes to tax, will less go into housing?

- What happens when all those deferred mortgages come due?

-

#6. What if there’s a second wave of COVID-19?

#7. Have you considered functional obsolescence due to changing behaviour?

What if people no longer want to live in high-density areas? What if commuting habits change?

#8. Finally, there’s already evidence of dropping rents.

Here’s a direct quote from rentals.ca: “The COVID-19 pandemic continues to put downward pressure on the rental market nationally, with rent down 7.2% from the market peak in September of last year.” How might that affect your appetite for investment — especially in centres where all hopes were placed on neverending appreciation?

In the past few days, more industry experts are beginning to concede that prices are likely to drop by 10% due to fallout from the pandemic. And, by the way, others are pointing to a potential price drop of 30-35%.

I hope they’re all wrong. With nearly 500 units, I would love nothing more than to see prices continue to rise. For now, my plan is prudence. If Warren Buffett can be patient, maybe I can too.

As for my rule of thumb about buying anything at 20% below market value, I may adjust that to 30%.

I’m not saying you shouldn’t buy, but…

…if you had a chart that shows prices dropping by nearly 20% over the next 18 months, why wouldn’t you use it?!

0 Comments